UK Exploration and Production Company, Tullow Oil, has received reports of frustration from its investors as it relates to low oil quality discoveries in Guyana’s Orinduik and Kanuku Blocks and must now think carefully about how it will proceed.

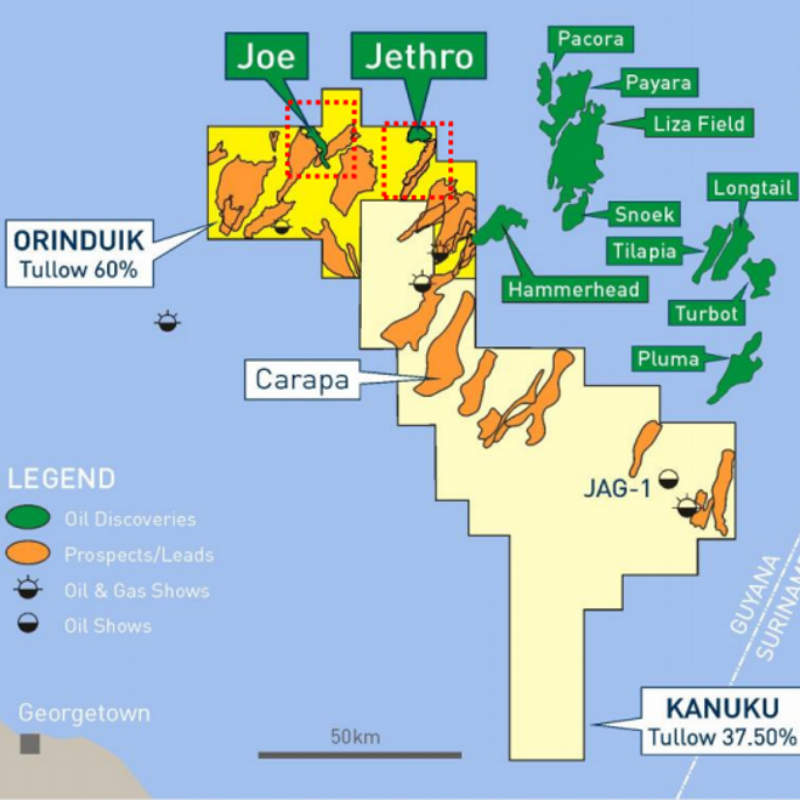

In its latest Annual Report, Tullow recalled that it had completed a three-well exploration campaign in Guyana in 2019, drilling the Jethro-1 and Joe-1 wells in the Tullow-operated Orinduik licence and the Carapa-1 well in the non-operated Kanuku licence.

In the Orinduik Block, the Jethro-1 and Joe-1 wells discovered 55 metres and 14 metres of net oil pay, respectively in Tertiary-age reservoirs. Full analysis of the oil found indicated both deepwater discoveries contained heavy oil with high sulphur content. In the Kanuku block, operated by Repsol, the Carapa-1 well drilled in a water depth of 80 metres discovered four metres of net oil pay containing good quality low sulphur oil, but in poorly developed reservoirs of Cretaceous age. The Carapa-1 well confirmed the extension of the prolific lighter oil hydrocarbon play in the Stabroek Block which is adjacent to Tullow’s acreage.

Upon reviewing the foregoing, Tullow said, “The Joe and Jethro discoveries in Guyana were ultimately disappointing with lower oil quality discovered than originally prognosed, and investors were frustrated…”

So far in 2020, Tullow has drilled one exploration well in Peru, which did not make a commercial discovery. In light of this, the operator said, “We will also be drilling in Suriname as well as thinking carefully about how to proceed in Guyana.”

Tullow said that the next steps in Guyana will be to integrate the three well results into updated geological and geophysical models, with a focus on the high-grading of the Cretaceous portfolio where better quality oil is expected across both the Kanuku and Orinduik blocks

For 2019, the total exploration cost write-offs for Tullow was €$1.3B, up from €$295 million in 2018. Tullow said that this was predominantly driven by a write-down of the value of its assets in Kenya and Uganda due to a reduction in the Group’s long-term accounting oil price assumption from US$75/bbl to US$65/bbl. The remaining write-offs include Jethro, Joe and Carapa well costs in Guyana as a result of drilling results and Kenya’s Block 12A, 12B and 10BA, Mauritania’s C3, PEL37 in Namibia and its Jamaica licence due to the levels of planned future activity or licence exits.