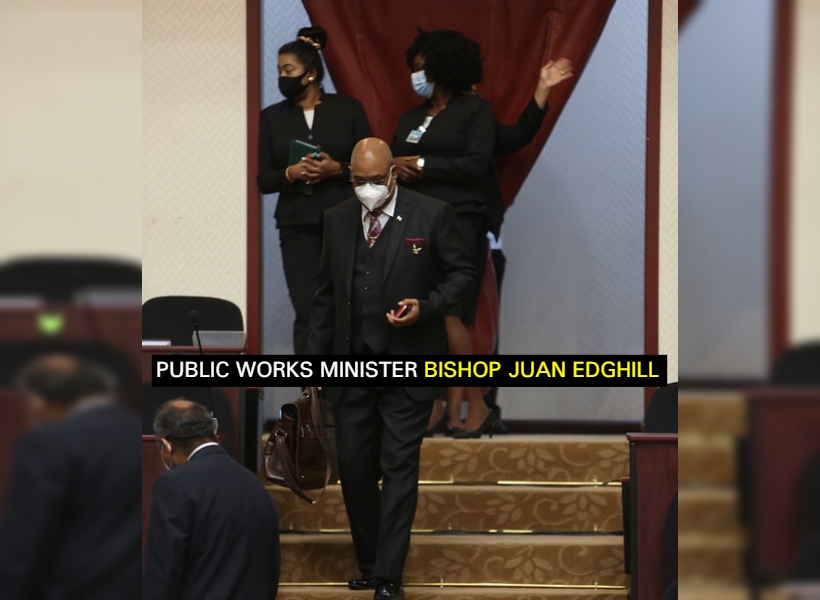

The removal of the 25% Corporate Tax on private education and healthcare service providers will make Guyana a beacon for world-class institutions, says Public Works Minister Bishop Juan Edghill. He made this remark during his presentation in the National Assembly this morning, as the House deliberates several bills to bring into effect measures announced by the Irfaan Ali-led government in the 2020 National Budget.

The minister, in seeking support of the House, said that the removal of the measure will make Guyana more attractive to reputable, foreign institutions. He added that with the tax being removed, added with the ejection of Value Added Tax (VAT), private institutions that are already operating in Guyana, will be allowed to maximize profits thereby making services more affordable to citizens.

With the cost of services being slashed, he anticipates that foreigners will come in droves to take advantage of cheaper education and health services, thereby increasing Guyana’s foreign earnings.

Also, students who come to Guyana to study, will also need accommodation and other services, thus stimulating economic activities in and around areas of private institutions.

He concluded by saying that the removal of this tax is a “pro-poor, poor-people and pro-investment” measure, and asked that the bill be supported.

A corporate tax is a levy placed on a firm’s profit by the government. The money collected from corporate taxes is used as a nation’s source of income. A firm’s operating earnings are calculated by deducting expenses, including the cost of goods sold (COGS) and depreciation from revenues. Next, tax rates are applied to generate a legal obligation that the business owes the government. (Investopedia)