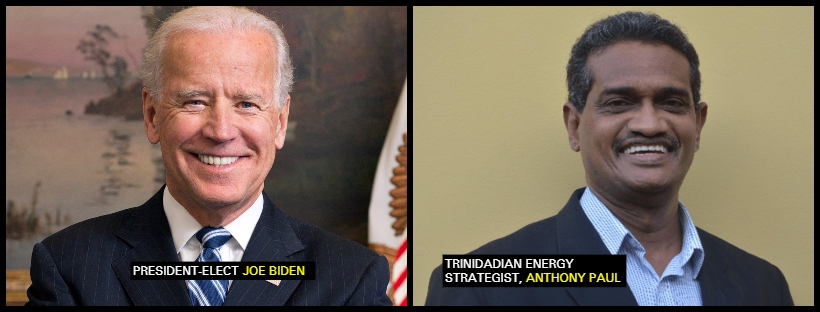

With Joe Biden defeating incumbent President, Donald Trump in the US 2020 Presidential Elections, Trinidadian Energy Strategist, Anthony Paul asserts that one can expect that Biden will accelerate the country’s embrace of and conversion to renewable technologies.

But even as Paul contented that Biden will make progress in this regard, the industry expert stressed that it would not be without significant resistance. Expounding further, the Trinidadian posited that “big business” runs America. The Energy Strategist said that America has a lot of installed old-generation infrastructure that is owned by these big firms and which is in the “harvest” phase of their life cycles. In other words, the capital is paid off and now, the time is ripe to reap the rewards.

As with the mobile phone technology, Paul said that some major American telecom companies persisted with less efficient Code-Division Multiple Access (CDMA) system for many years, even as the rest of the world and technology moved on with GSM. In the same vein, Paul said one should not expect power plants running on coal, oil or gas to be retired far before their profitable life ends nor refineries, storage facilities, retail stations, petrochemical plants, manufacturing with plastics, and other petroleum-derived products.

The Energy Strategist asserted that oil and gas companies make super profits in the upstream (production) part of the sector while noting that the big and powerful lobbyists will not likely give that up too easily.

Even then, Paul asserts that there are ways that Mr. Biden can promote renewables. In this regard, he said that the President can limit or halt the release of Federal lands and waters for oil and gas exploration and change the rules for flaring of natural gas in others. The Trinidadian was keen to note in this regard that the US’s share of gas flaring has increased tremendously in recent years with the production of gas associated with fractured oil reservoirs popularly known as shale oil and gas.

He further noted that a lot of these fields are remote from gas markets or pipelines to take them there, so producers choose to flare the gas and invest in the transportation to move the much more profitable oil.

Paul argued that these measures can move oil and gas prices in the short term.

“Keep in mind though that most of the fractured reservoir production comes from private or State-owned (as opposed to Federal owned) lands, which the President does not control. Much of these lands are in States whose legislatures are controlled by the Republicans,” Paul noted.

In response to his measures, the Energy Strategist said that oil producers can invest in the pipeline infrastructure and/or small scale conversion technologies to capture and sell/use much of this gas closer to production. This makes sense, as there are more cheap options to move liquid products, than there are to move gas. He said that these small scale technologies have been evolving, along with engineering and construction firms that make them into modular versions that are far cheaper to produce, often overcoming the economies of scale that were favoured by traditional technologies. Paul said that this is not insignificant to new gas producing countries, as the evolving small scale technologies can mean increased opportunities for domestic use of gas to meet the limited domestic and regional markets at competitive rates to large scale plants and can displace imports, while not having to compete in the global marketplace. This can also support producing countries in the ongoing revolution in the way domestic pricing for natural gas is computed.

Paul said that Trinidad and Tobago, Guyana, and Suriname may want to pay attention to these opportunities. In so doing, the industry expert said that they also need to pay attention to policies on domestic use of gas and pricing for domestic gas. On this front, he said it is prudent for one to bear in mind that low oil and gas prices have dramatically driven down the cost of oilfield services and equipment.

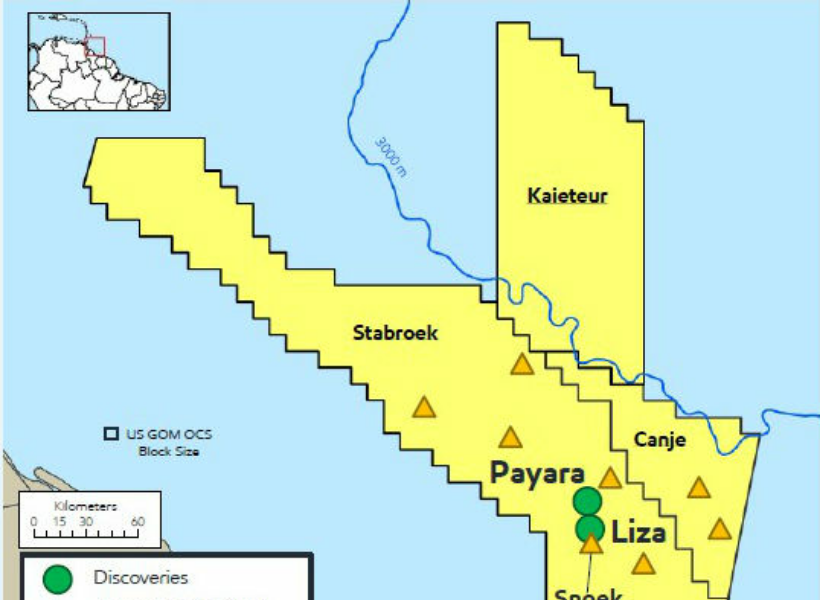

Paul said that the same happened after the fall of prices is 2014 and worked in Guyana’s favour. In this regard, he pointed out that ExxonMobil was able to capture the low cost and excessive supply to conduct massive seismic and drilling campaigns and move Guyana from a high-risk frontier area to a world-leading and low-cost oil centre in a matter of a few years.