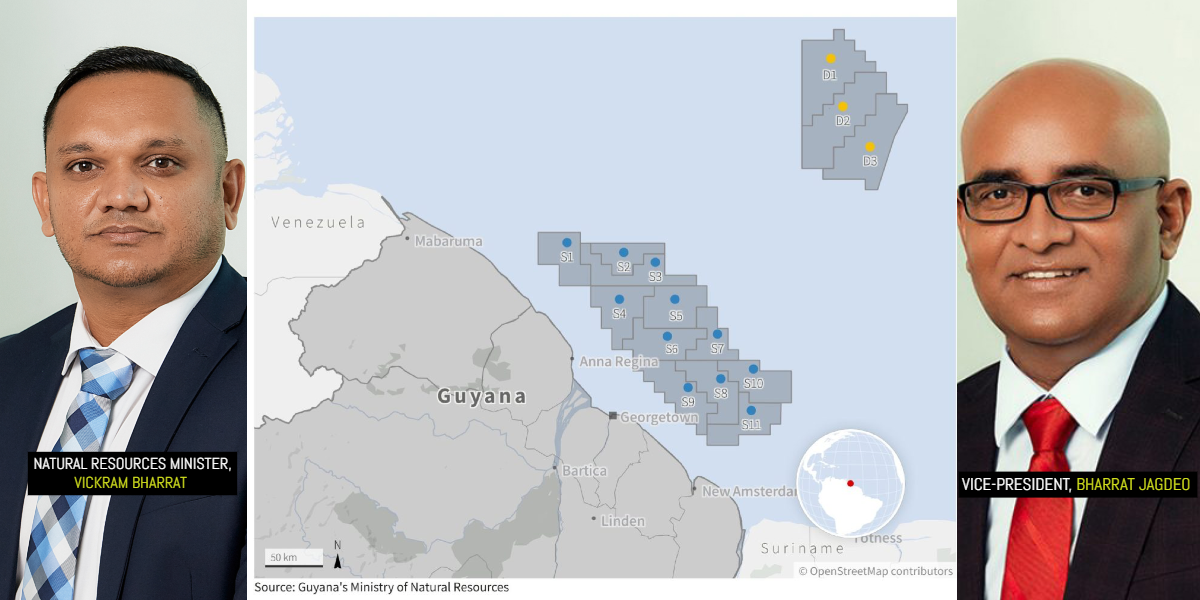

The Government of Guyana on Tuesday released through the Ministry of Natural Resources, two draft Production Sharing Agreements (PSAs) that will feature in the nation’s first oil blocks licensing round. Once the terms are finalized following a two-week national consultation process, the agreements will govern the 11 shallow water and three deep water blocks up for offer.

A preliminary perusal of the documents has revealed that most of the major fiscal terms are the same, save and except for the signing bonuses which are biddable items, along with other terms such as the rate of relinquishment.

Be that as it may, the draft Model PSAs allow for the contractor to pay an annual rental of US$ 1,000,000 during the exploration period.

Throughout the duration of the agreements, the contractor is required to pay annually to a government account, a training fee in the amount of US$1,000,000. The draft documents state that this fee should be used to provide Guyanese personnel nominated by the government with on-the -job training in Contractor’s operations in Guyana and overseas and/or practical training at institutions abroad. It is also to be used by the Government of Guyana for technical studies and advisory services necessary for the governance of oil and gas activities.

The draft agreements also place no value-added tax, excise tax, duty, fee, charge or other impost on the contractor or affiliated companies in respect of income derived from petroleum operations.

It also proposes that the contractor be exempted from the Property Tax Act.

The draft documents also note that the minister has the right to inspect and audit all of the contractor’s books, accounts, and records relating to petroleum operations for the purpose of verifying the contractor’s compliance with the terms and conditions under the agreement. Guyana Standard understands that the costs of any such audits shall be borne by the minister.

In accordance with the Environmental Protection Act, the documents state that the contractor shall obtain an environmental authorization as required from the Environmental Protection Agency and comply with the provisions of the Environmental Protection Act. It also notes that the minister and the Contractor shall establish a programme of financial support for environmental and social projects to be funded by the Contractor at US$1,000,000 per Calendar Year which shall not be recoverable.

On the issue of insurance, the draft agreements categorically state that the contractor shall have in effect at all times, insurance policies that cover but not be limited to: loss or damage to assets used in petroleum operations; pollution caused in the course of operations for which the contractor may be held responsible; loss or damage to property or bodily injury suffered by any third party; and the contractor’s/operator’s liability to its employees engaged in petroleum operations.

At the Minister’s discretion, the documents state that the Contractor may be permitted to self-insure all or part of the aforementioned insurances.

To ensure new investments are governed by a comprehensive framework of international best practices, the Natural Resources Ministry said an overhaul of the 1986 Petroleum Act and Regulations is forthcoming.

Guyana Standard understands that feedback on the draft model agreements should be addressed to the Minister of Natural Resources and sent to [[email protected]](mailto:[email protected] “”) with the Permanent Secretary copied, [[email protected]](mailto:[email protected] “”).

It was on December 9, 2022, that Guyana released the preliminary terms for an oil and gas tender covering a total of 14 offshore blocks, including 11 deep water blocks and three shallow water blocks. Guyanese authorities estimate that the blocks included in the tender have aggregate reserves of 25 billion barrels of oil equivalent resources.

The main commercial terms are outlined below:

– A royalty rate of 10 percent

– Cost recovery capped at 65 percent

– Profit sharing of 50 percent

– A minimum signing bonus required from the bidders of US $20 million for deep water and US $10 million for shallow water blocks

In terms of tax, the tender provides that a corporation tax of 10 percent and a property tax of 0.75 percent will be levied on the participating entities (as applicable).