Dear Mr. Lall,

I am writing in reference to the “Blunt” section in the Tuesday edition of Kaieteur News dated July 11, 2023, with the caption “VP Jagdeo Dodging”. The statement goes on to state that “the Vice President, Dr. Bharrat Jagdeo is still to offer a convincing word for what is behind the secrecy with this interest rate inquiry that Guyanese really should know.”

I have no doubt that you have Guyana’s best interest at heart. I respectfully submit, however, that whatever you are doing should be done in a more responsible manner.

On the interest rate question, it is no State secret, and it can never be State secret because you are in possession of the answer wherein the interest rate can be derived from the financial statements of EEPGL, CNOOC and Hess. Any trained accountant, finance professional or economist can calculate the interest rate therefrom.

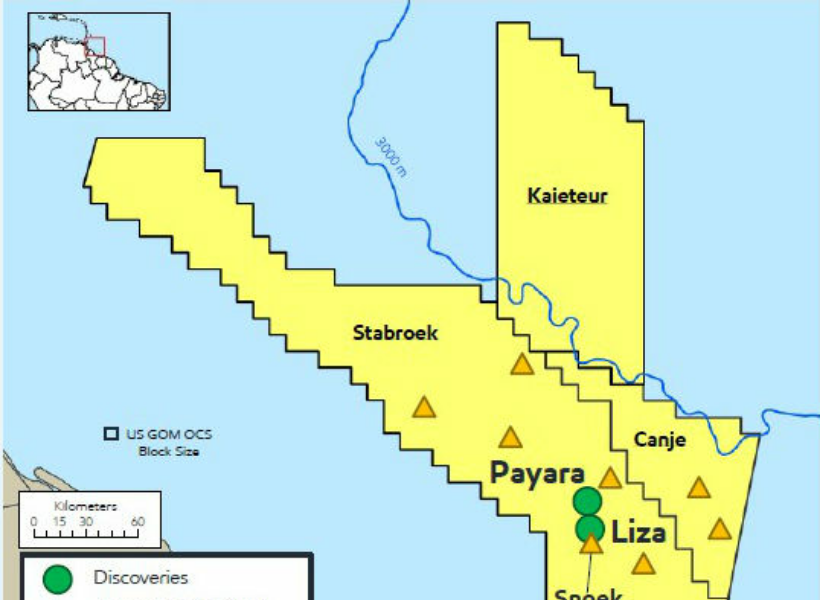

The figure that you consistently throw around of US$50 billion, I believe you are referring to the total committed investment by the oil companies for the Stabroek Block. That sum, however, is an estimated US$60 billion and not $50 billion.

More importantly to note is that your “Blunt” statement implies that 100% of the investment is financed by debt financing which is totally inaccurate. Financial institutions do not lend 100% financing for any type of investment, especially in the oil and gas industry given the high capital-intensive nature and risks characteristics of the industry. As you know, in Guyana’s case, it was not until 20 years later following the discovery of oil in commercial quantities―before oil production began. This means that considering the lifecycle from the exploration phase, development phase and production phase; it takes a minimum of 15 to 20 years, provided that there is a commercial discovery, before revenue is generated to commence repayment of any debt. As a trained banking and financial professional, I am not aware of any institution, locally or internationally, that extends a 10, 15, or 20-years moratorium for any type of debt financing.

As such, these types of investments in the oil and gas industry are financed largely from equity financing, cash flow from operations, and a small portion of debt during the operation stage. The Floating Production Storage and Offloading (FPSO) Vessels are typically financed by way of a lease, which is a form of debt financing.

Having said that, I would like to address the interest rate question explicitly, which I have dealt with on several occasions, but you refuse to publish any of my writings on oil and gas issues.

For the financial year ended December 2022, the finance and interest cost reported on EEPGL, Hess and CNOOC’s financial statements amounted to G$23.5 billion, representing 1.23% of the gross revenue and 0.6% of the total assets for the period which stood at G$4 trillion or US$19.2 billion.

The debt-to-equity ratio as of FY 2022 was 55.76% and the debt ratio was 35.8%. This means that the total assets of EEPGL and its co-ventures is financed by 35.8% debt financing, which is in the form of a lease for the FPSOs, and the remaining 64.2% is financed by equity. For clarity, a lease financing arrangement is not the same as a loan financing instrument. From the notes reported in the financial statements, the implicit interest rate on the lease can be calculated. To this end, the implicit interest rate is 5.18%. Also, it should be noted that the implicit interest rate here in Guyana is lower that the cost of debt capital for ExxonMobil, the parent company of EEPGL by 22 basis points.

In the final analysis, the claim by your “Blunt” statement that the interest expense on US$50 billion will cost a minimum of US$2.5 billion for all of the developments in the Stabroek Block is erroneous. The debt ratio is relatively low as shown herein, and, therefore the interest expense will be relatively low as well.

Please feel free to consult with an accountant or financial professional of your choice to conduct an independent analysis of EEPGL, Hess and CNOOC financial statements for 2022. I can guarantee you that their findings will be no different from what I have presented to you in this missive.

Yours respectfully,

Joel Bhagwandin