Shareholders of Hess Corporation voted on Tuesday to approve a US$53 billion sale to Chevron Corporation. Despite this step, the ongoing arbitration case between ExxonMobil and Chevron still casts a shadow over the transaction’s finalization.

At the heart of the dispute is Exxon’s lucrative oil drilling projects in the Stabroek Block, where Hess is a junior partner. ExxonMobil contends that the sale of Hess to Chevron violates the terms of their partnership, and filed the suit along with its partner CNOOC noting that Hess has to offer its stake in the Guyana project to them first before pursuing a sale to a third party. Chevron and Hess have disputed this interpretation, maintaining that their agreement with Exxon does not preclude the sale.

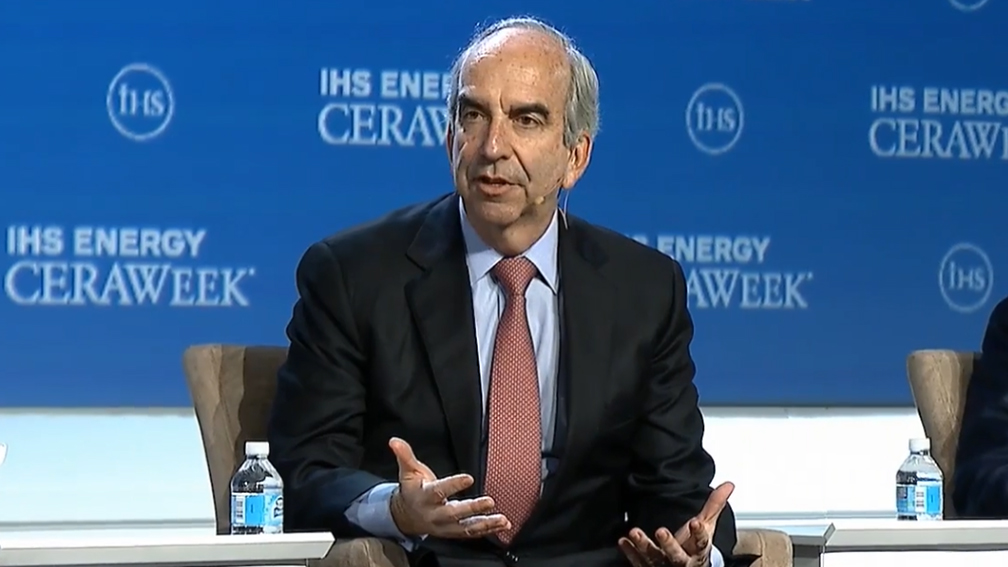

This legal process introduces uncertainty into the Chevron-Hess deal, potentially delaying its completion until a ruling is issued. According to ExxonMobil’s Chairman and Chief Executive Officer (CEO), Darren Woods, the arbitration panel may not deliver a decision until the following year, leaving all parties involved in a state of anticipation.

The Hess shareholders’ vote comes after significant lobbying efforts by John Hess, CEO of Hess Corporation . Over recent weeks, Hess has been actively engaging with investors to secure their support for the sale, emphasizing the strategic benefits and future potential of the deal with Chevron. His efforts paid off, with a majority of shareholders voting in favour, although some had initially withheld their support in hopes of securing a higher offer from Chevron.

Aside from its stake in Guyana’s Stabroek block, Hess Corporation’s portfolio includes extensive oil and gas operations in North Dakota, the Gulf of Mexico, and Southeast Asia. These assets enhance the attractiveness of Hess to Chevron, which aims to bolster its global presence and resource base through the acquisition.