Vice President (VP) Dr Bharrat Jagdeo, today revealed that Bank of Guyana (BoG) will be cancelling the Mohamed’s cambio licence, in light of the recently imposed sanctions on Nazar Mohamed and his son, Azruddin Mohamed, as well as their entities, by the United States Department of the Treasury’s Office of Foreign Assets Control (OFAC).

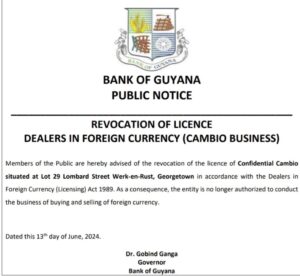

The disclosure by Jagdeo was followed by a notice published by the Central Bank informing of the revocation of the license for Confidential Cambio located at Lot 29, Lombard Street, Werk-en-Rust, Georgetown.

During his press conference held at the Office of the President, the Vice President noted that since Tuesday, when the sanctions were announced, the Government of Guyana asked the Financial Intelligence Unit (FIU) and Central Bank to prepare a report on the implications of the sanction for the country’s financial systems.

Jagdeo said, “The Central Bank of Guyana has already notified us that they have notified the Mohamed’s that they will be suspending their cambio license.”

He added that exposure to the Mohamed’s by local banks, and any entity of financial bearing, could have a direct impact on the local financial system. He underscored that under the OFAC sanctions, the government is obligated to safeguard the financial sector of Guyana.

“We want to safeguard our financial system,” he noted.

On Tuesday, OFAC sanctions the Mohamed’s for a series of corruption in Guyana. Mohamed’s Enterprise, Hadi’s World and Team Mohamed’s Racing Team, were also sanctioned. The U.S body said in their statement noted, “In addition, financial institutions and other persons that engage in certain transactions or activities with the sanctioned entities and individuals may expose themselves to sanctions or be subject to an enforcement action…”

Jagdeo explained that the FIU report and Central Bank reports will look at the implications for the country’s broader financial system. He disclosed that the government has also asked other agencies that have engagements with the Mohamed’s to review all transactions and also present a report to the government.

He continued, “And to ensure that we are in full compliance with the sanctions regime because we don’t want to expose our country to problems because of these sanctions and non-compliance with these sanctions. We don’t want to expose government entities to potential sanctions.”