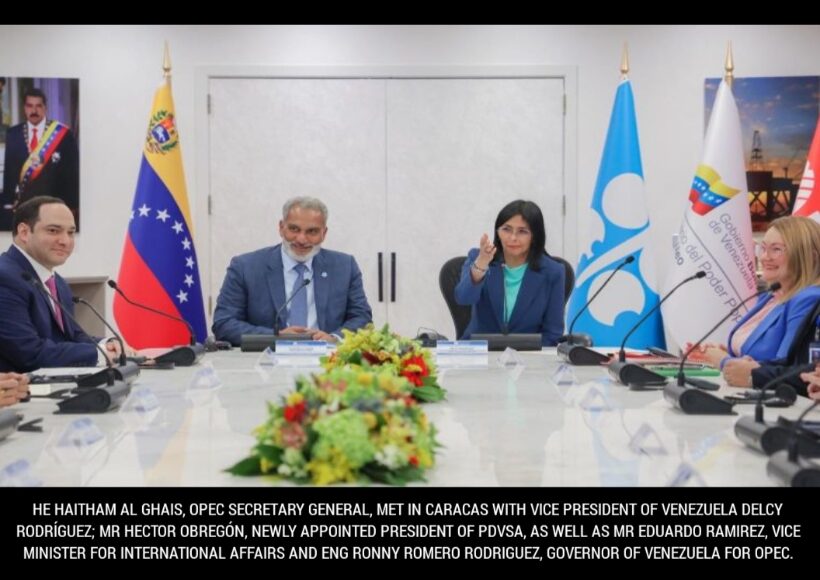

The Organization of the Petroleum Exporting Countries (OPEC) announced moments ago that its Secretary General, HE Haitham Al Ghais, recently held high-level discussions with Venezuelan authorities. The meeting included Hector Obregón, the newly appointed President of Petróleos de Venezuela S.A. (PDVSA), along with Eduardo Ramirez, Vice-minister for International Affairs, and Eng. Ronny Romero Rodriguez, Venezuela’s Governor for OPEC.

The meeting, which took place at the PDVSA headquarters, focused on addressing the global oil industry’s challenges, short- and long-term trends, and the vital role of the Declaration of Cooperation (DoC) in maintaining sustainable market stability.

HE Al Ghais also participated in a session with the company’s Board members, led by VP Rodriguez Gomez, where discussions highlighted strategies to tackle evolving industry dynamics and secure stable energy markets. The dialogue, according to a statement, underscored OPEC’s commitment to its member nations, aiming to build resilient market strategies that address the complexities of the global oil landscape.

These discussions follow recent reports by S&P Global Commodity Insights that Venezuela’s oil production by state-owned PDVSA and its foreign partners rose to 993,000 barrels per day (b/d) in July, marking an increase of 85,000 b/d over June. This surge was attributed to a rebound in production in the Orinoco Belt, Venezuela’s largest operating field, and oil fields in western Venezuela. Extra-heavy crude production in the Orinoco Belt alone rose to 595,000 b/d in July, 60,000 b/d more than in June.

Despite this rise in production, Venezuela’s oil exports declined sharply, dropping by 342,000 b/d to 415,000 b/d in July, according to S&P Global Commodities at Sea. Of the exported volume, 215,000 b/d were directed to the US. Moreover, Venezuela allocated 95,000 b/d to domestic ports, including 61,000 b/d earmarked for anchorage zones, the highest since November 2023.

Spain has recently emerged as a primary market for Venezuelan crude after the US Treasury Department authorized Repsol to expand its joint venture production efforts with PDVSA. Since then, shipments to Spain increased significantly to 113,000 b/d in May and 115,000 b/d in June, up from an average of 12,900 b/d during the first quarter of 2024. However, exports to Spain plummeted to just 29,000 b/d in July, reaching a four-month low.

While no direct Venezuelan crude was shipped to China in July, around 126,000 b/d was loaded for Malaysia, which may ultimately reach Chinese ports. In the first half of 2024, Venezuela shipped 196,000 b/d directly to China, highlighting its strategic energy relationships despite current US sanctions.

The political situation in Venezuela still remains tense following the disputed July 28 presidential election. Protests have erupted throughout the country after Venezuela’s National Electoral Council (CNE) declared current president Nicolas Maduro the winner with 51.2% of the vote, based on 80% of ballots counted. In contrast, the opposition claims that their candidate, Edmundo González, won with 69.5% of the vote, citing 73.2% of ballots counted.

While these protests have not yet affected crude production or refinery operations, they have led to gasoline shortages due to disruptions in fuel deliveries. Venezuela’s refineries also continue to operate below capacity, requiring regular imports of gasoline and blending components.

Industry insiders suggest that if González eventually takes office, the US could ease sanctions on Venezuela, potentially allowing the country to boost its oil production and gradually regain its footing in the global energy market.

Despite these challenges, Venezuela remains a critical player in OPEC due to its vast oil reserves, estimated at 303 billion barrels, and its natural gas reserves of 200 trillion cubic feet (Tcf).

ABOUT OPEC

OPEC, established in 1960, stands as a leading force in the global energy sector, comprising 13 member countries, including Saudi Arabia, Iraq, the UAE, and Venezuela, among others.

The organization aims to coordinate and unify petroleum policies among its members to secure fair and stable prices for petroleum producers, while ensuring a regular supply of oil to consumers and a fair return on capital for investors.